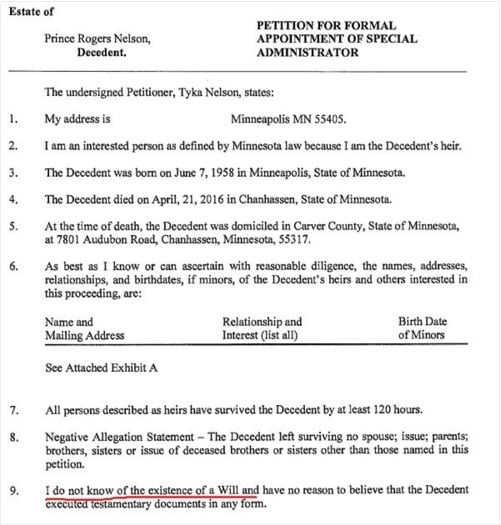

According to documents filed with the Minnesota Probate court this morning, it appears highly likely that music legend Prince died intestate. In other words, Prince had no will and no trust. This morning his sister Tyka filed a Petition for Formal Appointment of Special Administrator, requesting that Bremer Bank be appointed to administer the celebrity’s estate. Tyka stated in the document that she did not “know of the existence of a will” and had “no reason to believe the decedent executed testamentary documents in any form.”

Under both California and Minnesota Probate law, a special administrator must be appointed by the court when someone dies without a will. This is to facilitate the transfer, sale, and distribution of the decedent’s property. In this case, the decedent was Prince Rogers Nelson, a man who is worth approximately $150 million at present, and whose name and music will likely generate many, many more millions in the future. With so much money at stake, the potential for lawsuits over the musician’s estate is high, if not inevitable.

How is an estate distributed when there is no will or trust?

As I outlined in my recent video about Prince’s estate, when someone dies without a will or trust the state assumes a will for them and distributes their estate according to intestate succession. Intestate succession is just the legal way of saying: “according to a list of family members outlined by the state government.” Generally, the order of distribution to family members begins with a spouse and continues with children, parents, and then siblings. Because Prince had no spouse, no children, and no living parents, his siblings are next in line to inherit his fortune. According to the documents filed with the court, his sister Tyka lists 5 potential beneficiaries in addition to herself. Each of the listed siblings is a half sibling of Prince. She also states in the docs that “the decedent has heirs whose identities and addresses need to be determined.”

How Can no Will leads to lawsuits?

In some instances, a lack of estate planning documents will not have a significant impact on the transfer of one’s estate when they die. For example, if one has a spouse when they die, the spouse typically inherits the entirety of their estate. Alternatively, if one has children who get along, distribution will also be fairly straightforward. And of course, if one dies with virtually no money or property, lawsuits are just as unlikely to occur. None of these scenarios are the case with Prince’s estate. Instead, Prince’s estate has all the qualities of an estate rife for lawsuits and litigation. Lawsuits and litigation (fighting with lawyers) means a large portion of the estate will likely be eaten up by attorney’s fees. For an large estate such as Prince’s, this may not have a significant impact on the beneficiaries, or heirs’ bottom line. For smaller estates, extensive litigation can mean attorneys get the majority of one’s inheritance.

Red Flags for Lawsuits in Prince’s Estate:

-No will or trust means there is no proof of who Prince intended his money to go to, which means there is more room to present arguments for or against Prince’s true intent. In other words, a relative or business associate of Prince can offer evidence that Prince intended to leave some amount of money to them or their cause. This was done in the case of Simpson’s co-creator Sam Simon in which his girlfriend argued there was an oral contract to make a will.

–Siblings and half siblings are the natural heirs. Siblings are not necessarily the natural heirs to one’s bounty, such as a spouse or a child. As such, siblings are more likely to fight over who gets what. Blended families, such as Prince’s, are even less likely to get along peacefully. And with so many siblings (at least 6) it becomes increasingly difficult to come to an agreement on how assets should be dealt with.

-Large, valuable Estate. A large estate that consists of multiple properties, bank accounts, and other assets is that much more attractive to fight for a piece of. In addition, it is increasingly more complicated to organize all the assets and decide whether or not they are to be sold or kept by the beneficiaries. None of this, of course, takes into account the hefty estate taxes he will owe – some of which could have been avoided had he done an estate plan.

-Celebrity Name and Likeness. Celebrities, particularly artists and musicians, can often be worth more after their death than during their lifetime. Take Michael Jackson, for example. His estate has reportedly made in excess of $400 million since his death in 2009. In Prince’s case, they will have to determine who will have the rights to his name and likeness, and who will be in charge of managing it. Furthermore, if they fail to accurately assess the value of his name and likeness, the IRS may come after the estate for failure to pay adequate estate taxes. This is currently the situation with Michael Jackson’s Estate.

In terms of the value of Prince’s estate, his lack of estate planning will prove detrimental. As for his family members, they could be in for a long, emotional battle to receive their inheritances. For probate litigators in Minnesota, their heyday has come. And for the rest of us, we can sit back and enjoy the news – because if Prince really had no estate plan, everything that happens will be public information.

Petition for Formal Appointment of Special Administrator filed by Tyka Nelson for Prince: