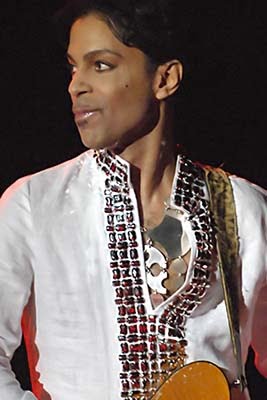

If the debacle of music legend Prince’s Estate doesn’t inspire you to get your Estate Plan in order, I don’t know what will.

With an estimated $300 million at stake, multiple family members and people claiming to be family members, Minnesota Judge Eide announced they were entering “uncharted territory.”

With no will yet to be found, determining how to distribute his considerable assets is becoming increasingly complex. A complex Estate case such as this one can go on for years – and years. And still more years. But let’s focus on the present:

Monday’s hearing was regarding the determination of Prince’s heirs. Wealth management firm Bremer Trust has been tasked with conducting DNA tests on potential heirs. Today’s hearing was set to determine the best way to go about administering said tests. While most of the potential heirs are unknown to the media, the results of one such test already conducted was leaked. The DNA test of a prison inmate who long claimed to be Prince’s son came back negative. Currently, Prince is known to have fathered only one child who died shortly after birth.

The Minnesota district court has already established that at least six siblings will likely be entitled to a share of the estate. Prince’s sister, Tyka, and five half siblings each have attorneys who were present at today’s hearing.

Regardless of how the estate is distributed among Prince’s heirs, the U.S. government is a guaranteed beneficiary. With no tax planning whatsoever, Prince’s estate will be subject to the full estate tax, which could be equal to as much as half of the estate’s value.

It’s somewhat unclear what will happen with regards to the distribution of Prince’s estate. One thing is for sure though – by not doing an Estate Plan, Prince inadvertently left hundreds of millions to the government and attorneys. And the rest he left to “heirs,” some of whom he probably didn’t even know very well.

Pretty scary estate plan, right?

Even if you do not die with a taxable estate (you don’t get taxed unless you have in excess of 5.45 million), estate planning is still crucial. Otherwise, the courts will decide for you who gets your property. And in the process, much of that could be eaten up by attorneys’ fees.

I’m an attorney, and even I wouldn’t leave money to other attorneys.