Unlike famous singers Aretha Franklin and Prince, who died without a will or trust, rapper Mac Miller planned ahead for his demise. And he did this at the tender age of 21 – perhaps foreseeing his death at just 26 years of age on September 7th of this year. Consequently, his fortune will likely be distributed privately and without complication. Prince and Aretha’s estates however, will likely be tied up in a legal tangle for years to come.

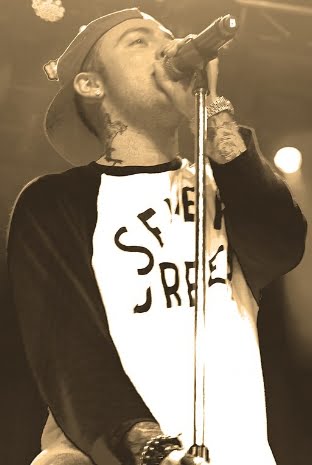

Miller, whose legal name was Malcolm McCormick, released several popular albums beginning in 2011, leaving him with an estimated $9 million at the time of his death. Known widely as the former boyfriend of celebrity artist Ariana Grande, his albums included “Blue Slide Park”, which hit No.1 on the Billboard 200 chart, “Watching Movies with the Sound Off”, and “The Divine Feminine”. His final album, “Swimming”, was just released last month.

Mac Miller, according to documents obtained by The Blast, made a will and set up a trust in 2013, named the Malcolm McCormick Revocable Trust. Lawyer David Byrnes was appointed to serve as the administrator of his estate, and his brother, Miller McCormick, was named as secondary administrator. As settlor and initial trustee, Mac was able to manage the assets in his trust while also retaining the ability to revise the trust until the time of his passing. It is assumed that he left his estate to his parents, but there is no solid information as to who his estate was actually left to.

Some news reports have said Mr. Miller left his estate to his parents, but experts said this is just speculation. He could have left his estate to his favorite charity, friends, or other family members and organizations.

A revocable trust, such as the one Mac Miller made, is also known as a “living trust”. It is an estate-planning tool that avoids probate, the proceedings of which can drag on for months and cost thousands in legal fees. Besides keeping proceedings out of the probate courts, revocable trusts keep the details private, unlike simple wills which are a matter of public record. Trust documents are seldom filed with the court, whereas the probate process of simple wills or intestate estates (no will) is a public proceeding. Anyone can go to the courthouse and see what documents are filed there. If an estate goes to probate court whatever you own – and who gets it or fights to get it – is public knowledge.

Along with the revocable trust, a special type of will known as a “pour-over will” adds security for assets that are not added – or re-titled to the trust. A pour-over will works in conjunction with your trust, and is typically done in California Estate Plans. If assets are not listed in the trust they will simply “pour over” into the trust when the estate is settled. The “pour-over will” acts as a shield against issues that can frustrate the smooth operation of a living trust and provide additional protection against legal issues that may arise. In addition, many pour-over wills include language that creates a “testamentary trust” using the terms of the revocable trust, should the trust document somehow become invalid. Michael Jackson also died in California with a Trust and pour over Will in place.

Mac Miller had reportedly been struggling with drug problems for a number of years – which is potentially what motivated him to do his estate plan. Whatever his motivations, it is still admirable he took such prudent steps to protect his beneficiaries. In many cases, it is not the attorneys fees, the time, or the public nature of probate that become the biggest costs of putting off your estate plan – it’s the suffering created for your family by the additional stress and hardship.

Of course, for those worth over $11 million, a solid estate plan can also prevent millions in taxes going to the federal government.

We wish Mac Miller’s family the best in this very difficult time.

For questions about a Revocable Trust, Will, Health Care Directive, or Durable Power of Attorney, contact our Walnut Creek Trust and Estate Law Firm at 925-322-1795.