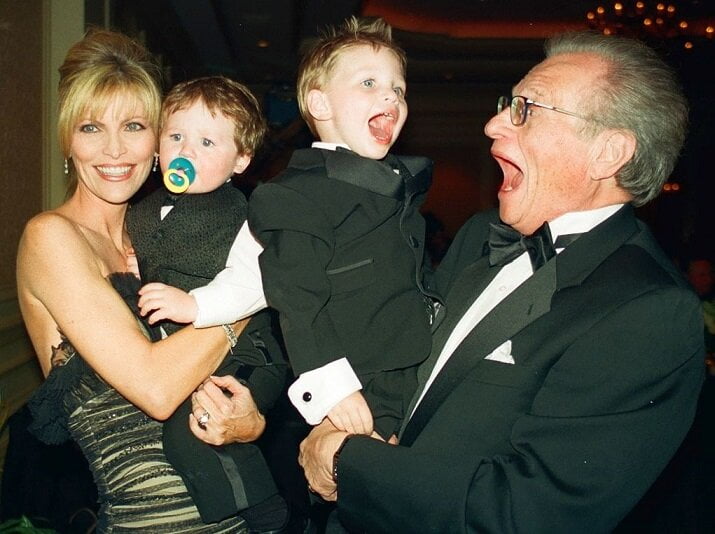

On January 23, 2021, Lawrence Zieger died. Known globally as Larry King, he left behind 8 marriages to 7 different women (he married his 3rd wife twice). His kids ranged in age from 65-20. Sadly, two of them pre-deceased him. From an estate perspective, this is ripe for fighting and litigation.

Almost immediately, his family sought Court action. One of his children, Larry King Jr, brought a petition in Los Angeles Court to be in charge of Larry King’s probate estate. A bit of clarification is needed now. There is a legal difference between a Probate Estate and a Trust Estate. This can be complicated, but if you put together a Trust, often times no probate estate is needed. A Probate Estate has to go through the Court, a Trust Estate does not. It appears that in 2015, Larry King put together a complex Trust with his last wife Shawn King. However, he was in the middle of an active divorce to Shawn King when he died.

If you have a Trust in place, a probate estate is only needed if there are assets outside of a Trust. You have to think of the Trust like a bucket. You put all of the assets into the Trust bucket. If there are any assets outside of the Trust bucket, then you end up with them in the probate estate.

Here, Larry King, Jr. claims that there is a probate estate worth at least $2,000,000. Total funds in Larry King’s name are estimated at $144 million.

Jr.’s Petition seeks to be in charge of these funds (the $2 mill). Jr. also filed an emergency petition seeking to be appointed Administrator of the probate estate on a temporary basis. Emergency, temporary Administrations are known as “Special Administrations.” He argues that he should be in charge over Shawn King, because Larry King was divorcing Shawn King when he died. California law gives Jr. priority to be Administrator over Shawn due to the divorce.

Jr. also argues in his Petition for Letters of Special Administration that there are a number of ongoing business duties that must be handled. He argues that these business issues justify the emergency appointment of an Estate Administrator.

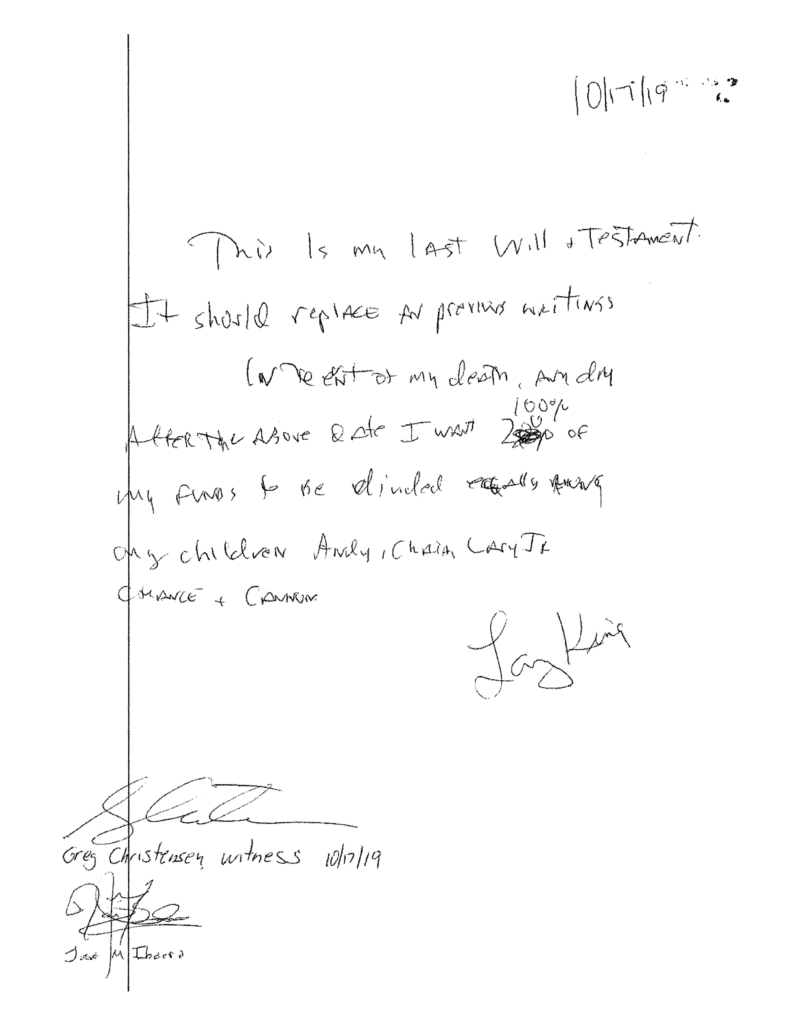

He also argues that there is a Will handwritten by Larry King that distributes everything equally amongst his kids. There is an alleged hand written will attached to the paperwork. This document is a bit hard to read, but does appear to state that Larry King’s entire estate should be distributed amongst his children. Again, that would not apply to the vast majority of King’s estate, which is in the family Trust.

Shawn King is fighting with her step-son over this Will. She filed an Objection to basically everything Larry King Jr. filed. She says that the Will is not valid. She alleges that Jr. pressured his dad into signing this document. She says that there is no need for an emergency administrator because all of the business duties Jr. discusses are handled through the Trust. Again, there is a distinction between Trust and Probate that is extremely important here. Larry King Jr. is trying to say he needs to be appointed due to these business duties being handled through the probate, but Shawn says that is not necessary as they are handled in the Trust.

Shawn King also alleges that Larry King had a secret account where he gifted Jr almost $300,000. Shawn King says some of her community property would be in the account and so these transfers are void and inappropriate. She argues that this creates a debt Jr. must pay the Estate. She takes it one step further stating that since he owes the estate money, it is a conflict of interest precluding him from managing the Estate.

Shawn King also filed a counter Petition for Letters of Administration, in addition to her Objection. Shawn seeks to have an older Pour Over Will approved by the Court. She states that the assets outside of the Trust are only $350,000, not $2 million. Pursuant to this older Will, those assets should not be transferred to the five children of Larry King but instead to the King Trust to be distributed pursuant to the terms of that document.

Shawn King and her lawyers are coming out fast and hard as they are likely bracing for a much longer litigation ahead. Her lawyers even went so far as to “paper” the assigned Judge – asking for their matter to be heard by another Judge, who ostensibly they feel will be more favorable to their client.

The bottom line of this right now is that this hand written Will put forward by Larry King Jr. is only relevant to a small portion of the estate. News outlets estimate Larry King’s net worth at $144,000,000. If $2,000,000 is in the probate estate, then this would be an exceptionally small battle in this larger situation. $2 mil is a lot of money to almost everybody but not to the King family, it would appear. If the actual amount in dispute is $350,000 (as Shawn King states), then it is even a smaller issue.

Given these numbers, the real battle lies in the Trust, not the Estate. I do not have a copy of the Trust and none is attached to any of the pleadings. It may emerge at some point, if we’re lucky. Shawn’s objection vaguely describes the Trust. My estimate, based on the description, is that the Trust was established in 2015 between Larry and Shawn. After Larry’s death but during Shawn’s lifetime, she is most likely the sole beneficiary to the Trust. All of the money is solely for her care. Parts of the Trust are set in stone and she cannot modify them. Parts of them are not set in stone and she could modify them. It is not clear to me what assets of the $144 million (or thereabouts) are in which parts of the Trust.

It seems likely that Larry’s five children are the beneficiaries to the Trust in some fashion after Shawn passes. While Larry King was almost 90, Shawn King was actually only 61 (men, right???). So, if she is the lifetime beneficiary of the Trust in some manner and the kids only inherit after she passes away, then they may be waiting for a while.

However, if a person puts a distribution into a Trust to their spouse and then gets divorced, the distribution is deemed invalid. In August, 2019, Larry King filed for divorce against Shawn. However, it was not completed to my knowledge and Larry King’s passing causes the family law court to lose jurisdiction (ie they have no further power over the King divorce). This means that the distributions to Shawn King in the King Trust would be maintained and not invalidated. If Larry had only finalized the divorce during his lifetime, it would have functionally revoked the King Trust, likely distributing everything to his children instead of Shawn. By delaying this process, now there is this looming litigation between his wife and children. I have handled several Trust matters where the settlor dies mid divorce, and it can get very very heated.

This situation will probably get worse before it gets better. Shawn will most likely attack Jr. on multiple other fronts. She already states that he barely even knew his father. Jr. will most likely retaliate with allegations from the divorce as to why Larry King wanted to divorce Shawn. Jr. may bring an action in the Trust to fight over the assets there. Who wants to wait 30 years to get access to the $144 mill? So, buckle up and expect a wild ride here in LA!