Earlier this year I wrote about the Celebrity Estate Planning Tragedies of Phillip Seymour Hoffman, Marlon Brando, Howard Hughes, James Brown, and James Gandolfini.

Recent events and a few discoveries on my part have compelled me to add to that list of Celebrity Estate Planning Tragedies – and I’m not just talking about Prince.

PRINCE

Prince made the worst, most obvious, and also most common estate planning mistake of all – he failed to do an Estate Plan at all. By doing so, he left considerably more money to his heirs (five siblings) than he may have wanted and inadvertently gave millions to attorneys, private banks, and the US government. In addition, his wealth could have potentially benefitted a number of charities and other worthwhile causes, but instead will go to the government, lawyers, and heirs who may not be capable of managing such a large influx of cash.

Lesson: Do your Estate Plan!

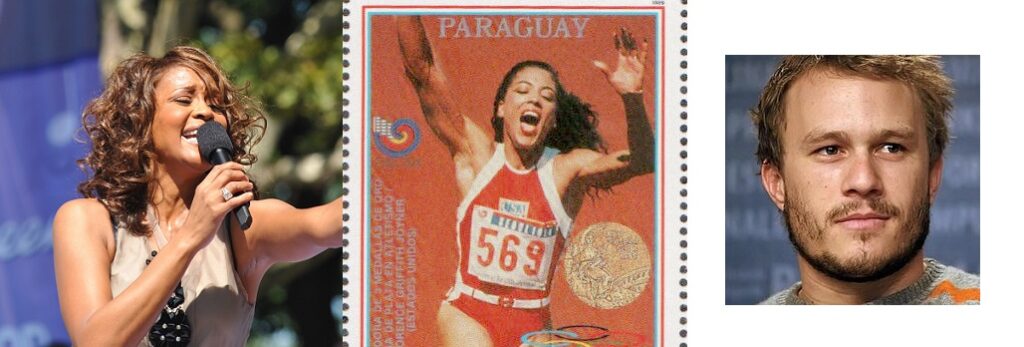

WHITNEY HOUSTON

Unlike Prince, Whitney Houston took the prudent step of drawing up her estate plan. Unfortunately, she never updated it after her daughter was born. Just prior to the birth of her daughter Bobbi Kristina Brown in 1993, Whitney drew up a Will and Trust. Over the next 18 years, her wealth grew to a fortune of over $20 million. According to reports, her estate planning documents allowed for Bobbi Kristina to have 10% of the fortune at age 21, and the rest paid out later. This meant that at age 18, Bobbi Kristina was given a payout of approximately $2 million dollars. By not updating her estate plan, Whitney failed to account for whether or not her daughter would be capable of handling such a large amount of money. Bobbi Kristina unfortunately died shortly after turning 21. Her boyfriend at the time was recently found guilty in a wrongful death suit.

Lesson: Update your Estate Plan to account for beneficiaries’ level of maturity, personality, and general situation in life.

MICHAEL JACKSON

Michael Jackson acted prudently by creating an Estate Plan. Unfortunately, he failed to place a substantial amount of his assets in the Trust. This is called failure to “fund” a trust. When someone creates an Estate Plan, the largest part of their plan is typically the creation of one or more trusts. Trust documents protect assets, avoid probate, and spell out a distribution plan. However, in order for a trust to work as intended, it must be funded. This means assets have to be re-titled in the name of the trust. Because Michael failed to take this important step, his estate – and its beneficiaries – have been in and out of probate court numerous times.

While the possibility of going to court can never be completely avoided, not funding one’s trust increases the likelihood of litigation, high attorneys’ fees and time in court.

Lesson: Create a trust and be sure to re-title your assets in the name of the trust. Ask your attorney for help if necessary.

HEATH LEDGER

Heath Ledger died tragically in early 2008. The young actor had indeed created a Will, but he (or his attorney) had failed to include the possibility that he might have children at the time of his death. Heath’s Will left his entire estate – $20 million – to his parents and three sisters, and completely omitted his daughter. Whether or not one has children at the time they create their estate plan, a good Will or Trust should provide for the possibility of children born in the future. Many people make the mistake of thinking they will update their Will when/if any major life changes occur, but many don’t get around to it. Luckily for Ledger’s daughter, relatives revealed that the majority of his assets would be put in a Trust for his daughter.

Lesson: Provide for the possibility of new heirs, such as children or grandchildren

FLORENCE GRIFFITH JOYNER

Like Heath Ledger, Olympic track and field gold medalist Florence Griffith Joyner had a Will. Unfortunately, she never told anyone where it was located. A lack of original estate planning documents is perhaps the main key to Pandora’s Box of down and dirty family fighting. Joyner’s estate was litigated for nearly four years before the family was able to come to a settlement, and assets could be distributed. It’s unknown how much was spent on attorneys’ fees, and how many relationships were ruined by the fight. For

Lesson: Keep your Estate Plan in a safe place, like a Safe Deposit Box